Is it time to jump in the lake?

There are many reasons why someone may buy or sell a home. Mobility issues, space needs, affordability, financial and employment can all factor in. Regardless of the reason, the one ingredient that should not be understated is confidence.

You have likely been there. You are up north, standing at the edge of a dock or standing on a chunk of that glorious Canadian shield rock as you prepare to jump into the water.

Is it cold?

What’s it going to feel like?

Yikes. I’m not sure. Are you going to do it too? Promise!!?

Ok. Let’s count to 3. No. Wait. Count to 10.

Oh man. Ok. Let’s do this.

No wait…

We all know how this typically ends. Exhilarated and nervous, Sarah eventually takes the leap and jumps in.

What changed?

Did the water get warmer? Probably not.

Did their friend jump in first? Did enough people peer pressure her to take the leap?

Whatever it was, she had the nudge she needed to do something that after doing it, she's thrilled she did.

Let’s change lanes to the world of real estate.

On June 5th, the Bank of Canada lowered the overnight rate by 0.25%, reversing the previous increase of the same amount back in July 2023 and ending a spree of rate increases that started back in early 2022.

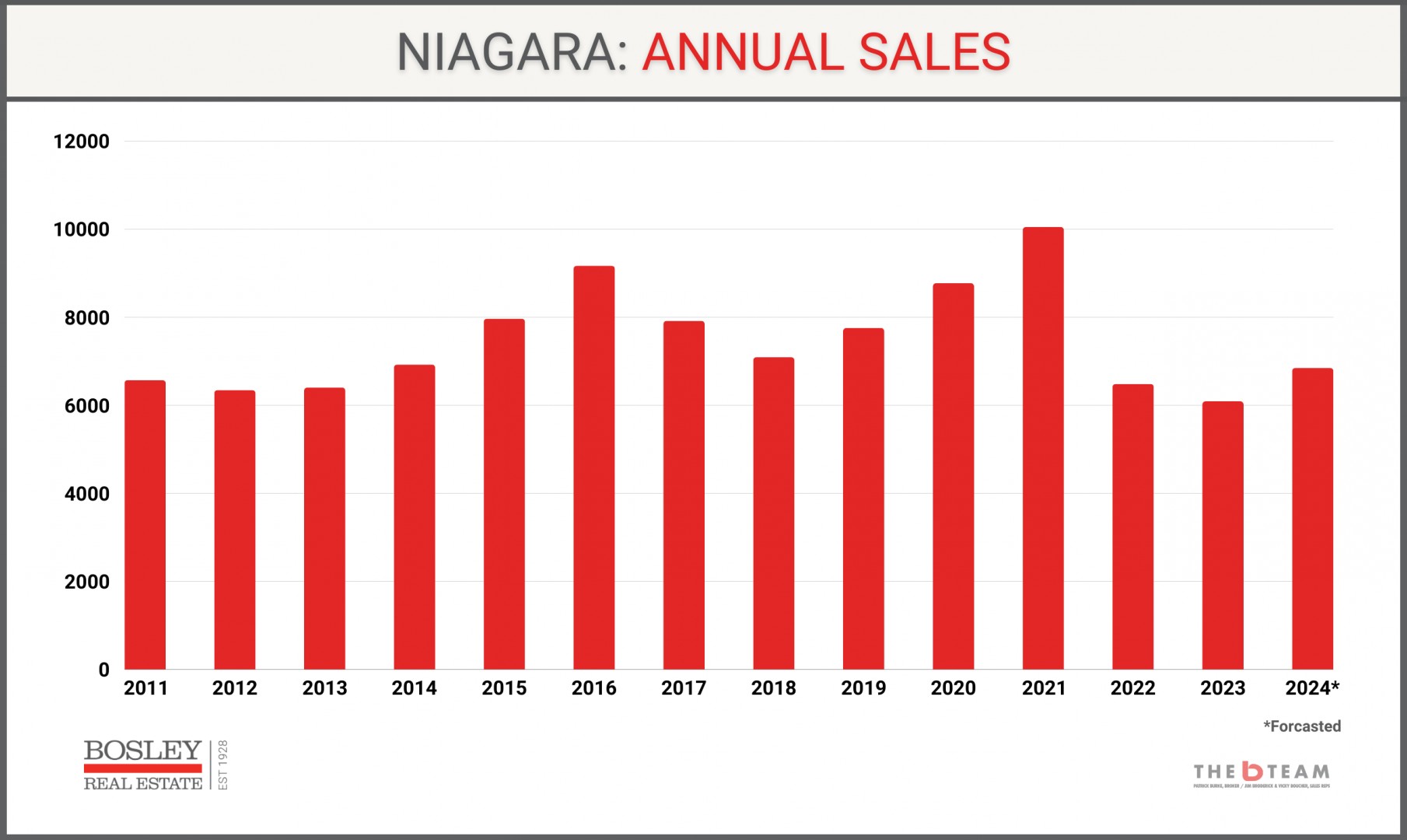

Going back to the cottage dock, those rate increases made it easy to say ‘no thanks’ and stay on the dock. With each rate increase, all of your friends wrapped themselves in a towel and said, ‘maybe later’. As rates went up, confidence retreated. Sentiment moved from nervous to absolutely frozen, a fact evidenced in our sales numbers over the past few years.

Case in point, 2023, we had the lowest number of annual sales in the last 15 years (and beyond that). Exhibit A:

And as mentioned earlier, it wasn’t just confidence, however, the overarching sentiment clearly soured as uncertainty and instability reigned supreme.

Many felt that waiting until the BoC reduced rates was the prudent step. Afterall, once that happened, everything would return towards normal. Right?

Well, that really depends on the individual and what their goal is. Afterall, there is a significant difference between only selling and only buying. Likewise, the path forward for those who are selling and buying is different.

But regardless of the above, increased rates made the water feel colder and the jump seem higher. It was easier to wrap up in a towel and have a seat, thank-you very much. Afterall, there was plenty for sale and prices were dropping.

I’d be crazy to jump in now!

Let’s talk about those prices.

The assumption or feeling has been that lower interest rates will equal cheaper carrying costs. The challenge is that that theory only works if prices are flat or declining. What if sale prices are actually inching upward? Will those increased prices swallow up any savings from reduced rates?

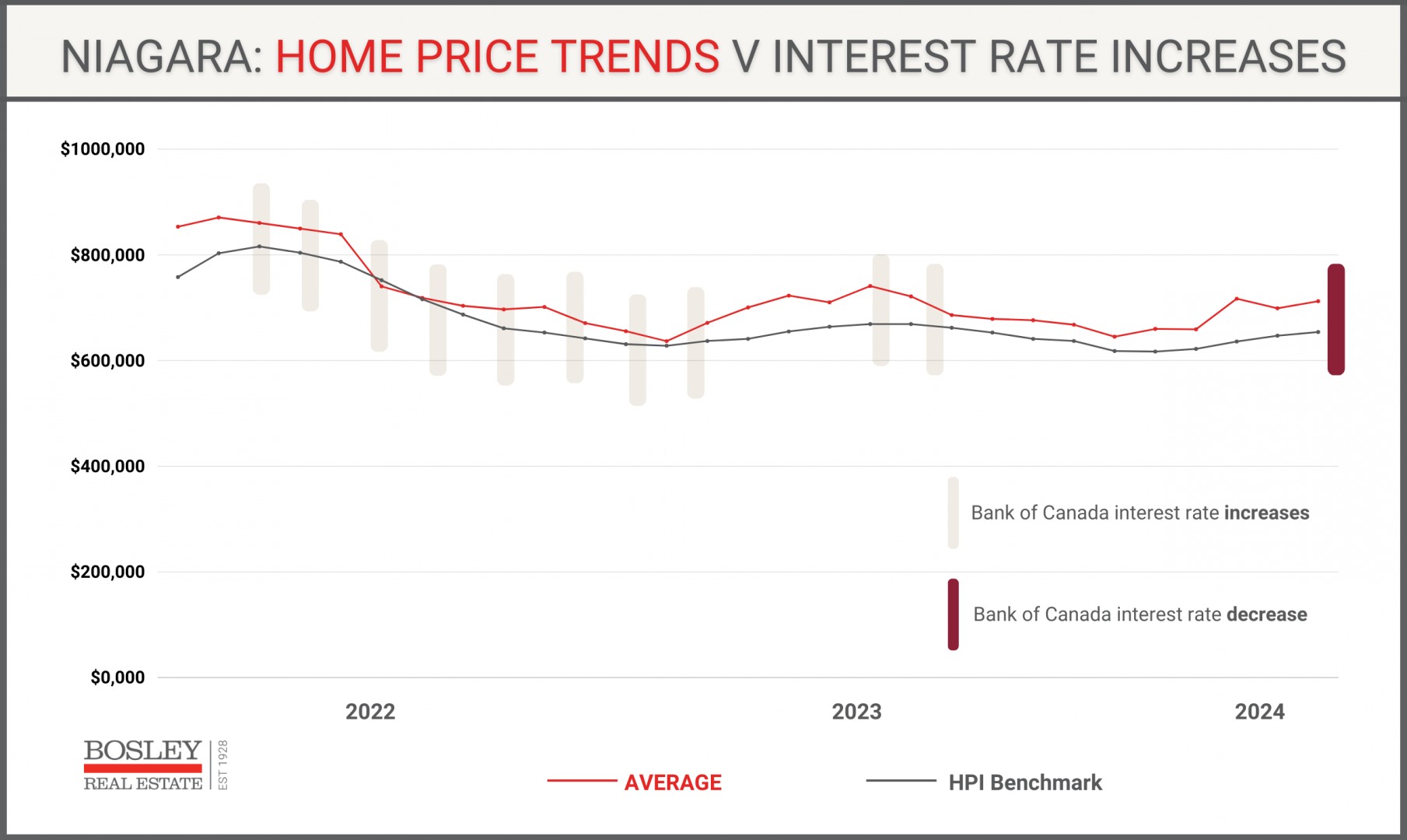

First, let’s look at price trends since early 2022, when this interest rate bonanza began.

You can clearly see a few things. One is that interest rates clearly had a blunt force impact on home prices. Even in early 2023 when the market was regaining the will to live, the BoC showed up with two measly 0.25% increases and just like that, no one wanted to jump in the lake again.

If you want a case study in patience and resilience, however, look no further than year-to-date 2024. While active listings and sales have been so wonky, prices have held and alas, steadily improved.

The diehard statistician may note that the HPI Benchmark price is even improving in 2024. That pricing data takes out the outliers and volatility so it is a piece of data that you can typically put more weight in. If that is moving in a positive direction, it’s worth paying attention to.

So, let’s get back to the dock. Sarah is still standing there, unblinking, wondering what to do.

It’s refreshing once you get in!

You’ll love it!

But…

And perhaps, here comes the nudge she needs to take the leap.

The Governor of the Bank of Canada, wearing his Captain’s hat, pulls up in a cedar outboard motorboat, cuts the engine, and while the boat effortlessly glides past, Sarah sees it. Maybe it’s just a wink or a gesture, but it’s what she needs to let go of that towel and jump. The slightest hint of confidence returns, and she...

Sarah jumps.

She’s in!

Is her heart rate elevated? Yes.

Is she still nervous? Absolutely.

But surely, she didn’t jump because the Governor of the Bank of Canada gave her a 0.25% nudge right?

In real numbers, 0.25% on a $500,000 mortgage equates to about $70 a month. Is $840 a year enough to leave the safe confines of that dock and leap into the dark, moderately mirky waters?

Probably not. But it might be enough to feel like it’ll be ok. It might be enough to make her feel comfortable that it will be ok and sometimes, that is all we need.

The Summer.

This will be a fascinating summer to watch. Much the same way 2023 was fascinating in a train wreck sort of way, 2024 and beyond will be interesting to watch as the market uncoils itself.

If you’re interested in keeping track, this would be a great page to add to your thumbnail bar. Rest assured, we’ll stay on the case and keep reporting back.

Want to chat?