Anytime a market accelerates in one direction or another, we, as humans, are quite keen to predict when things are going to change again, for better or for worse.

Case in point: Since late spring 2022, the Niagara real estate market has been struggling to post sales, with the monthly totals coming in well under the 10-year average.

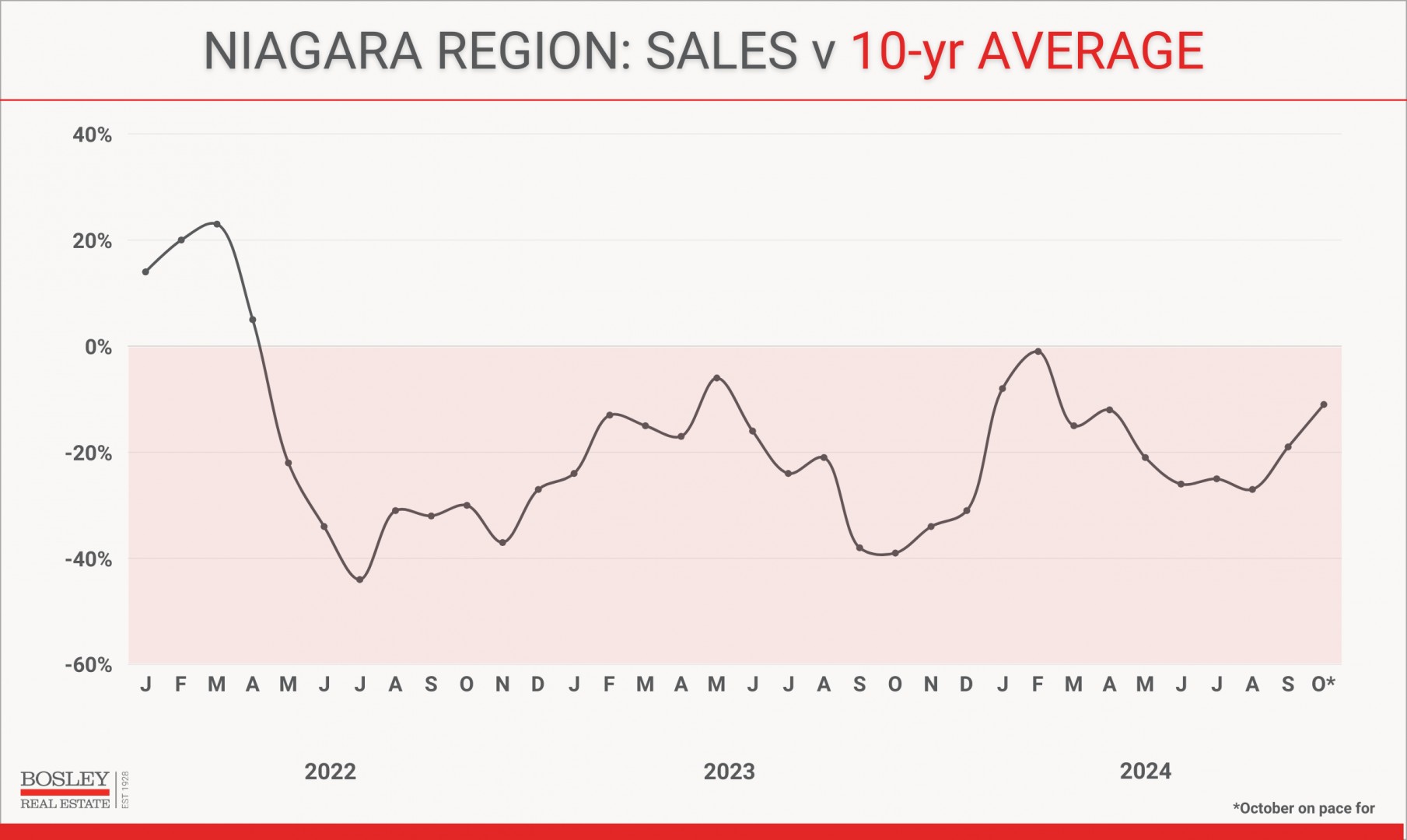

Exhibit A: the graph below shows the monthly sales as a percentage in relation to the 10-year average.

Anything in the red (below 0%) was that much below normal. Note the wild swing in early 2022. As we approach the end of 2024, we are seeing a notable improvement, with October on pace to approach only being 10% below the 10-year average. That would be the 4th best performance since April 2022.

Why might we see an improvement in sales?

REALISTIC PRICING

Pricing your home is difficult, particularly when we have such market volatility. Depending on where a homeowner goes for their information, they can find rationale for any number of asking price strategies.

From their cousin’s buddy who used to be an agent, to their uncle in Owen Sound who has moved a lot, to their neighbour’s house that’s been for sale for 147 days- misinformation is in ample supply.

As a home sits on the market, many sellers will re-evaluate their numbers and reduce their price. Case in point, in the Niagara Region, 29% of homes that sold in the last 30 days reduced their asking price before selling. Furthermore, 30% of all active listings have reduced their price, with many of them reducing multiple times.

We do not have a shortage of supply for buyers. What we have is a shortage of supply priced at levels that buyers feel comfortable paying.

As an example, look no further than the north-end of St.Catharines. For detached homes under $1 million, there are 119 for sale, with an average asking price of $752,000.

Meanwhile, in the last 30 days, 36 homes sold, with an average selling price of $660,000.

The unfortunate reality is that with so much buyer choice, it is very easy for a seller to price themselves out of the market. The homes that are priced reasonably will sell. The rest will do one of three things.

- Reduce their price and sell

- Expire and pack it in for the time being

- Remain on the market

Historically, the supply of active listings on the market has dropped by 30% (+/-) from October to December. Combining improving demand, reduced supply, and more realistic pricing, the start of the 2025 market will be positioned on much better footing.

IMPROVED AFFORDABILITY

So far, the Bank of Canada interest rate decreases have not produced the fanfare that many expected. In fact, when the BoC reduced rates in June and July 2024, the number of homes sold was worse than when they raised them in June and July 2023.

The impact of these changes in affordability won’t be instantaneous. There are many ingredients that go into the real estate “soup” of decision-making, and some of the external forces will require time before their benefits settle in.

The big one is this: With sustained high inventory, and sale prices largely flattened out, buyers are not experiencing a fear of loss. Yet.

“Why should I buy today if it’s going to be cheaper tomorrow?”

At some point, however, the buyers will start to feel that the train is leaving the station. With one foot on the train, and one on the platform, more will start to take the leap and get onboard. That will only happen, though, when there is improved forward momentum, which will require some things to work in tandem. They include:

- improved financing terms. Will the BoC lower rates twice more this year? The general consensus is yes. How much? That’s guesswork, but two more decreases will surely get more people on the train. At current levels, buyers are already ahead $60-70 per month per $100,000 of mortgage. With possible further improvements, at some point, buyers will see the opportunity to find their home and lock-in. This is the type of fluidity that the marketplace is longing to see.

- when sellers see other homes like theirs sell, it will motivate them to get their price closer to market value, and for many, that may simply be a $15,000 or 25,000 reduction.

- increased fear of loss will motivate people to make decisions. That might include sellers recognizing that if they want to sell, they need to get their price to a lower number. For many, they may recover that loss on their purchase.

- Toronto and the GTA markets need to loosen up. Like it or not, Toronto has become the oil in the real estate market for many regions within an hour or two of the big city. If we see a collective improvement in all of the above, that train may leave the station faster than many anticipate.

Given that we are starting to see glimpses of all the above starting to happen, it bodes well for the final few innings of 2024.

Here are the final points to consider.

- October is tracking to be decidedly average in terms of the number of sales, which is a victory in and of itself.

- Days on the Market are tracking to be marginally quicker.

- The number of active listings appears to have peaked.

- Pricing has held steady despite the imbalance in supply and demand. It is poised to show some life with any return of demand.

- Months of Inventory (absorption rate) began to ebb towards balanced market conditions for several Niagara municipalities from mid-September through mid-October.

The balance of 2024 will be very interesting to watch. Stay tuned to this page or reach out to us anytime for a chat.