Date Posted: 29/05/2024

Let's cut to the chase right out of the gate. The big picture market data for May 2024 is not pretty. Sales and active listings are both way off of where they should be. Here is where overall market data might paint an inaccurate picture as it relates to your home. Keep reading and you'll see that the impact isn't exactly what you might expect.

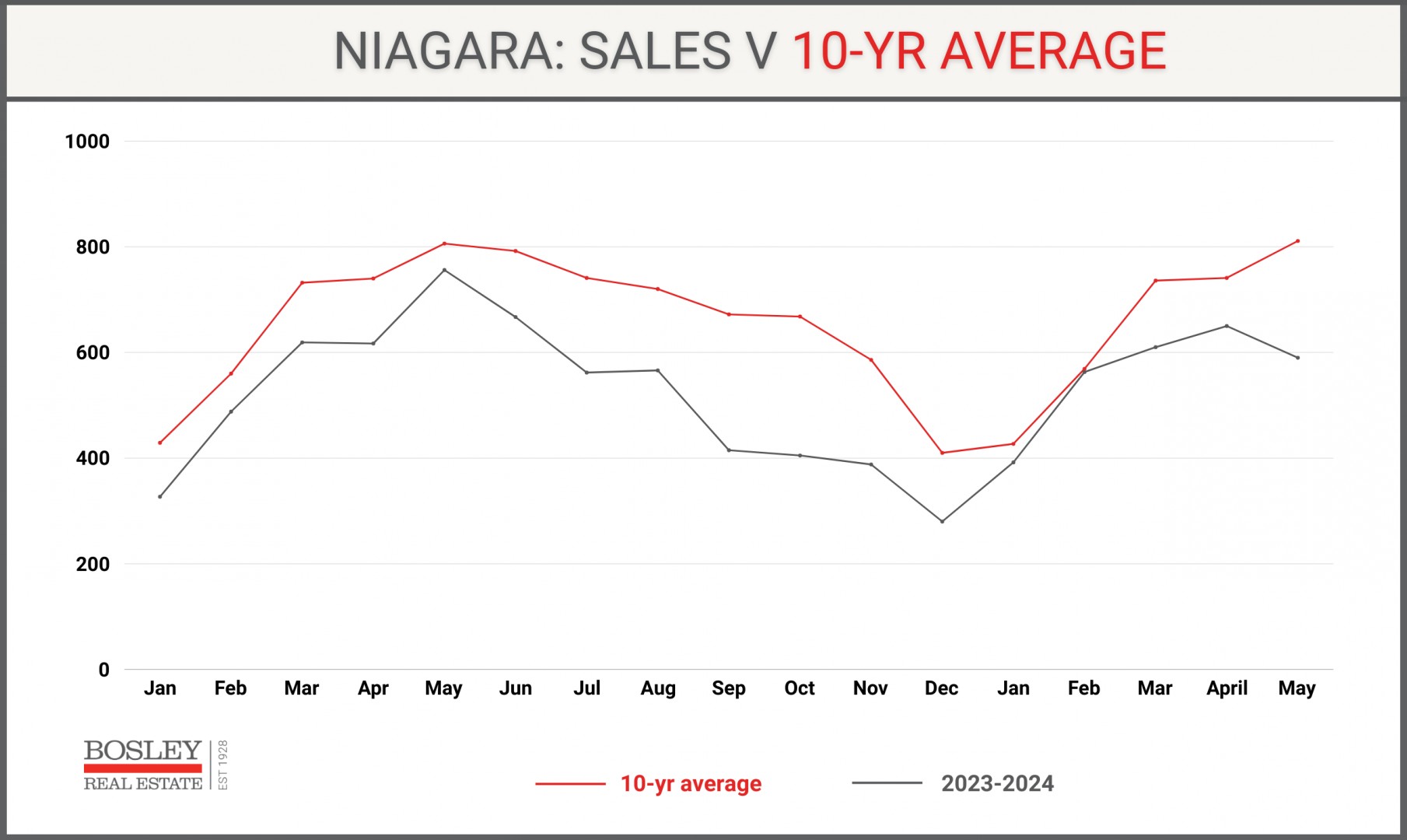

Sales v 10 Year Average

May 2024 sales are going to come in just under 600 for the month. That is the 2nd lowest total in the last 15 years. The previous low was May 2020 (COVID) which had 525 sales. To put that in context, the 10 year average for sales in May is 811.

This graph shows the 10-year average in red with the past 16 months in grey. Or in other words, what the historic norms were in comparison to what we're currently experiencing. Note the impact of the Bank of Canada interest rates from last June and July (2023) where sales pulled back through the rest of last year. Here in spring 2024, we've seen sales get stage fright yet again as they've pulled back well below where they should be.

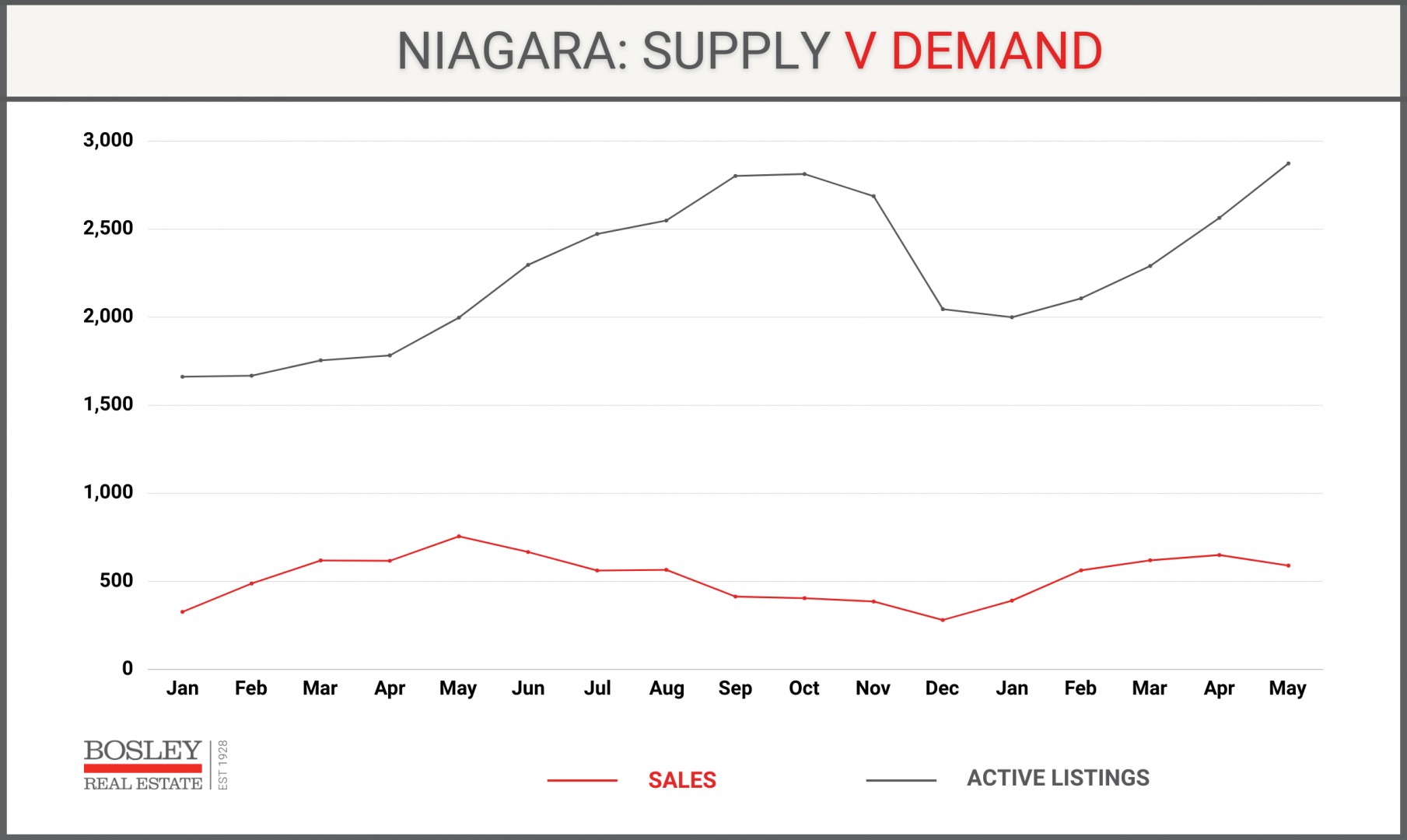

Active Listings v Sales.

Active listings for Niagara in May 2024 will be just under 2,900. That is the highest of any month when looking back over the past decade. May 2024 will have just under 1,000 more active listings than May 2023.

What does that mean? It is simply the number of homes that were actively for sale in the month. And what does it mean when there are higher active listings? The result is longer days on market, less absorption rate (sales), higher months of inventory, more buyer choice and more buyers market. And more importantly, if you're a home seller, your initial asking price needs to be grounded in reality. When a buyer has a lot of choice, it is easy for them to see yours as a reason to buy that other, lower priced home.

In a nutshell, in this graph, the wider the gap, the more the market favours the buyer. ie: note the impact of the June & July BoC rate hikes last year as the gap between supply and demand widened. And here we are in 2024 with the same thing happening.

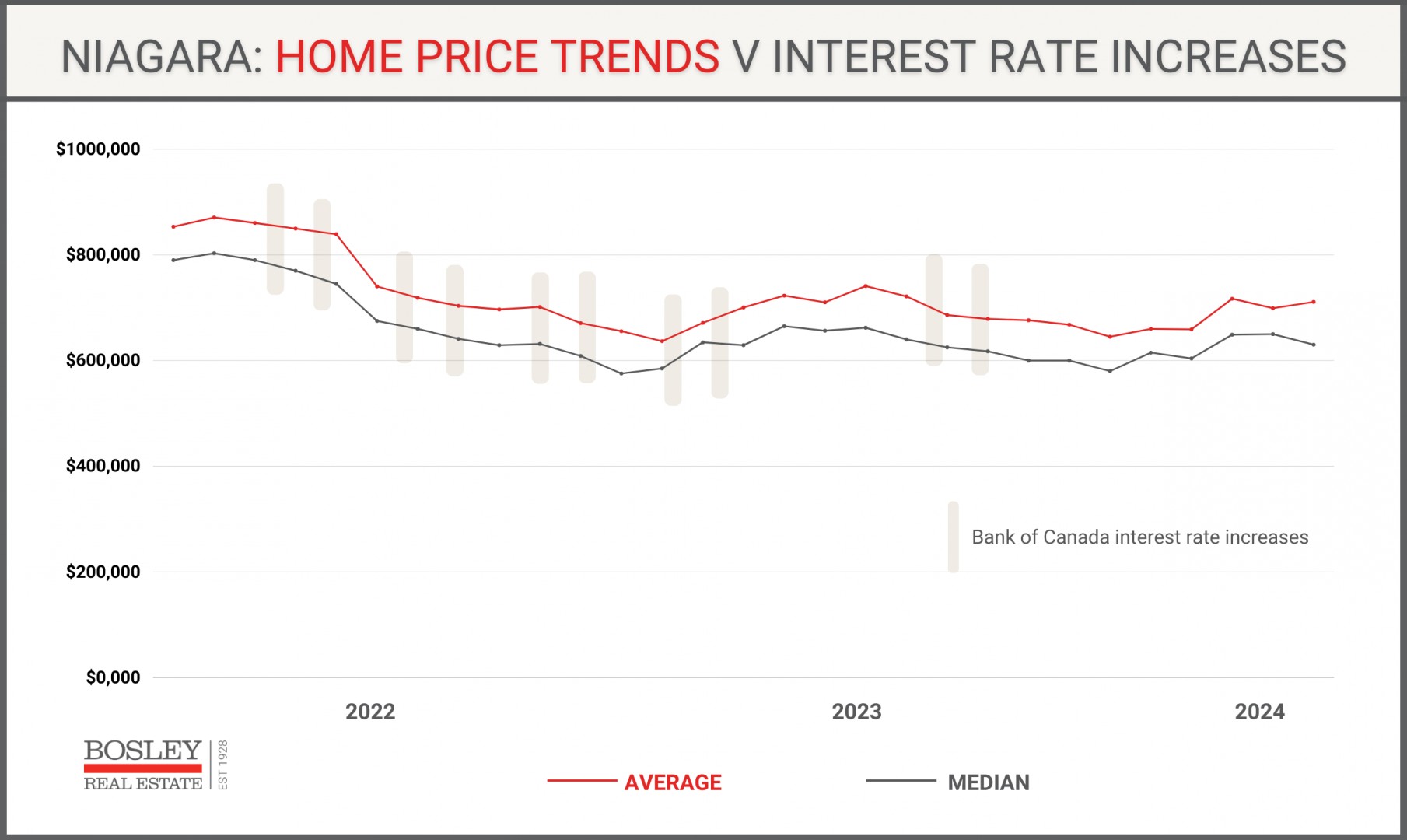

Pricing trends.

This is where things get even more interesting, if that's eeeven possible.

In spite of the imbalance of high supply & low demand, for a good chunk of the marketplace, market price seems to be established. Meaning, when a home is priced relative to reality and very recent sales, buyers are coming to the table. Contrary to what you may have learned in your high school economics class, while listings and sales are doing what they're doing, average and median prices have held and/or edged up in the last 90 days.

May 2024 average sale price is currently sitting at $712,000. It was $717,000 in March 2024. The last time the average sale price was above $700,000 before that was July 2023. The median sale price has been in the $630-650,000 range the last 3 months and again, those are values we hadn't been at since June/July 2023.

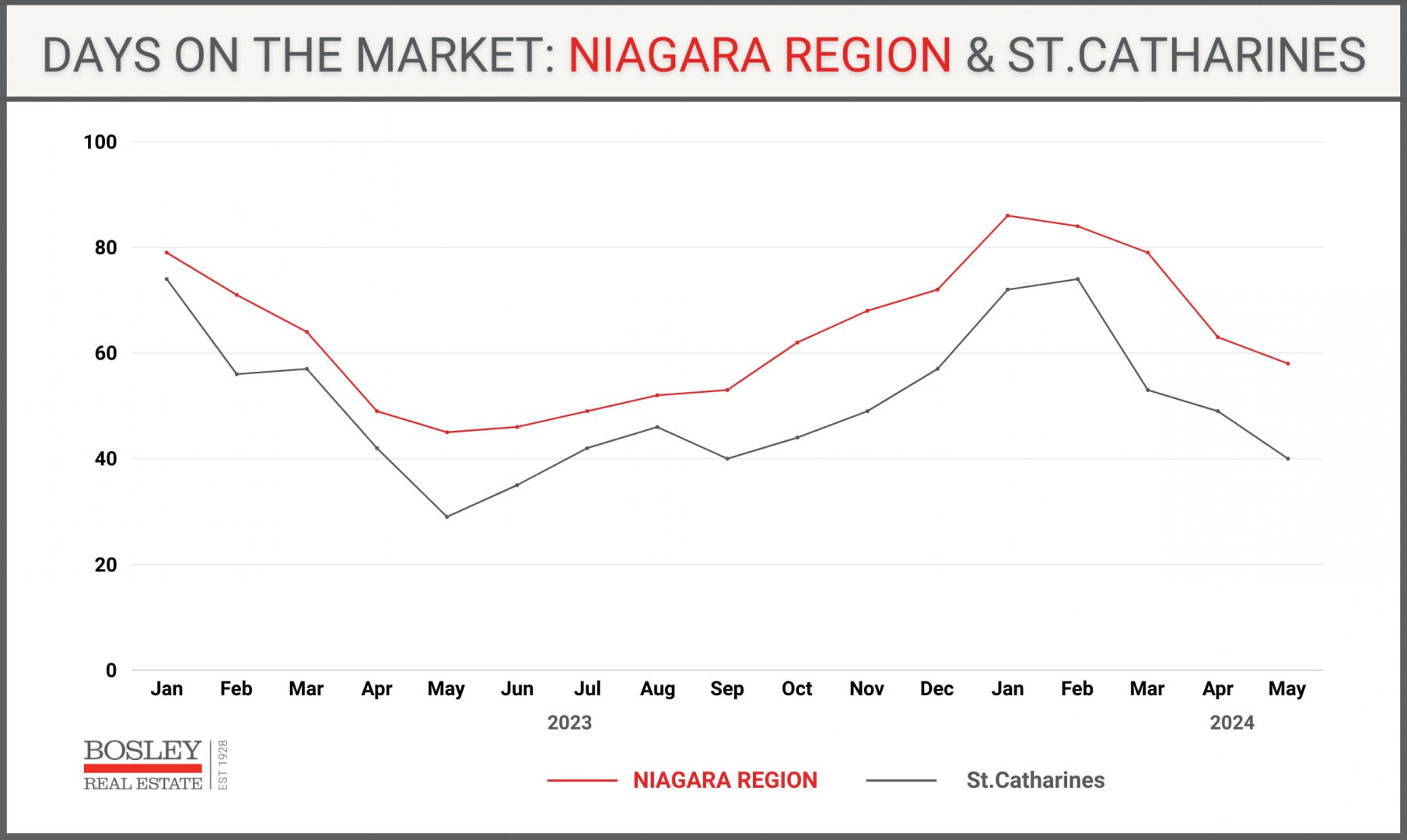

Days on the Market (CDOM).

Typically, when active listings are increasing while sales are retreating, the days on the market to sell a home should increase, but that is not the case here in 2024. In fact, the days on market values for homes that are selling has been steadily decreasing throughout 2024.

What does that mean? It means that while sales are 30% +/- below the 10-year average this month, when a home is priced accurately, there are buyers who are there to respond and make an offer.

How about active listings? Here is a look at the gap between active listings and sold listings:

The current days on market for all active listings in Niagara is 98 days. Meanwhile, homes that sold in May sold in 58 days.

For St.Catharines, that gap is 70 CDOM for actives and 40 CDOM for sales in May.

Niagara-on-the-Lake is 165 CDOM for actives and 92 CDOM for sales in May.

What happens next?

So, while the typical May data will be less than inspiring, there are opportunities and good values out there for both sellers and buyers. Are homes selling at peak values? No. But if your source of local real estate intel is the headlines, you may not be aware of the positive aspects of the market.

Looking to chat?