In real estate, confidence is king—and right now, the spring market is waking up slowly, caught between signs of recovery and the weight of global uncertainty.

OBSERVATIONS FOR THE 1ST QUARTER OF 2025:

The state of the real estate market is fully reliant on public sentiment. Predictability and some semblance of order are fundamental ingredients to fluidity in the marketplace. When stability and logic are in place, people are more comfortable selling and/or buying real estate. On the flip side of the coin, when uncertainty in any form arises, the market tends to take a step back. That brings us to the market here in early 2025.

It’s worth noting that Q4 2024 showed signs of a market that was returning to normal. With sales trending towards normal levels, GDP growth exceeding expectations, and the Bank of Canada continuing to lower the overnight rate, the horizon for early 2025 was looking positive. External factors can directly impact the market, however, and similar to 2008, 2020, and a few other lesser examples, that is exactly what we’re seeing now with the relentless firehose of global changes spurred on by our neighbours to the south.

Put simply, we believe the spring market is slowly emerging, but in light of current events, it is reluctant to get up to full speed. We will continue to monitor the data and sentiment, with the hopes of seeing some return towards normal in the coming weeks and months.

WHAT ABOUT THE FEDERAL ELECTION?

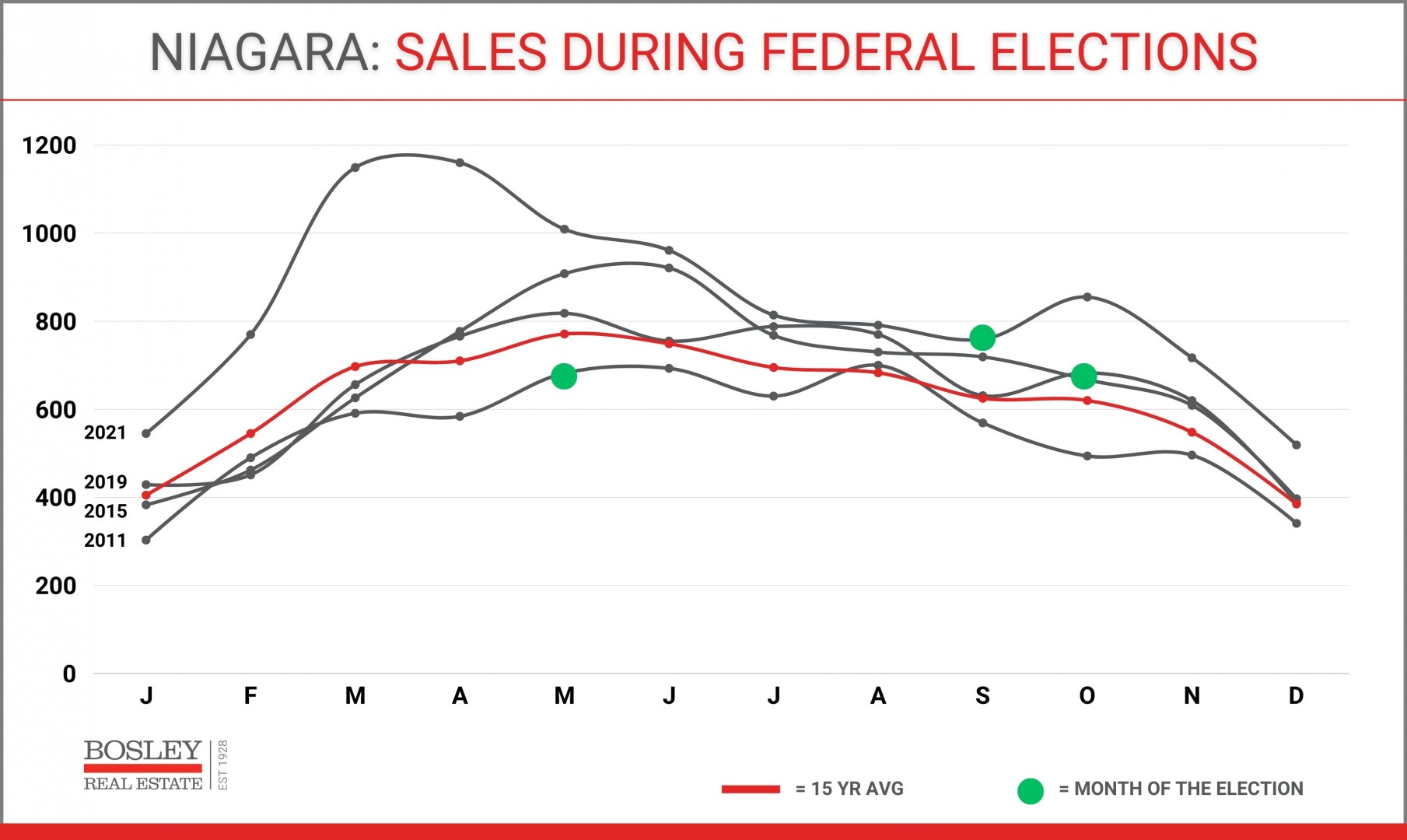

There are varying theories regarding the impact that a federal election can have on overall market activity. The chart below shows the previous four election years (in grey) along with the 15-year average for monthly sales (in red).

For Niagara, there has been no noticeable impact on monthly sales or price activity during a federal election. In general, the data from the months prior to or following an election has been in line with historical trends.

Clearly, there is more than just a federal election impacting the market, so the data around this year’s election will need to have an asterisk attached to it.

SALE PRICE TRENDS

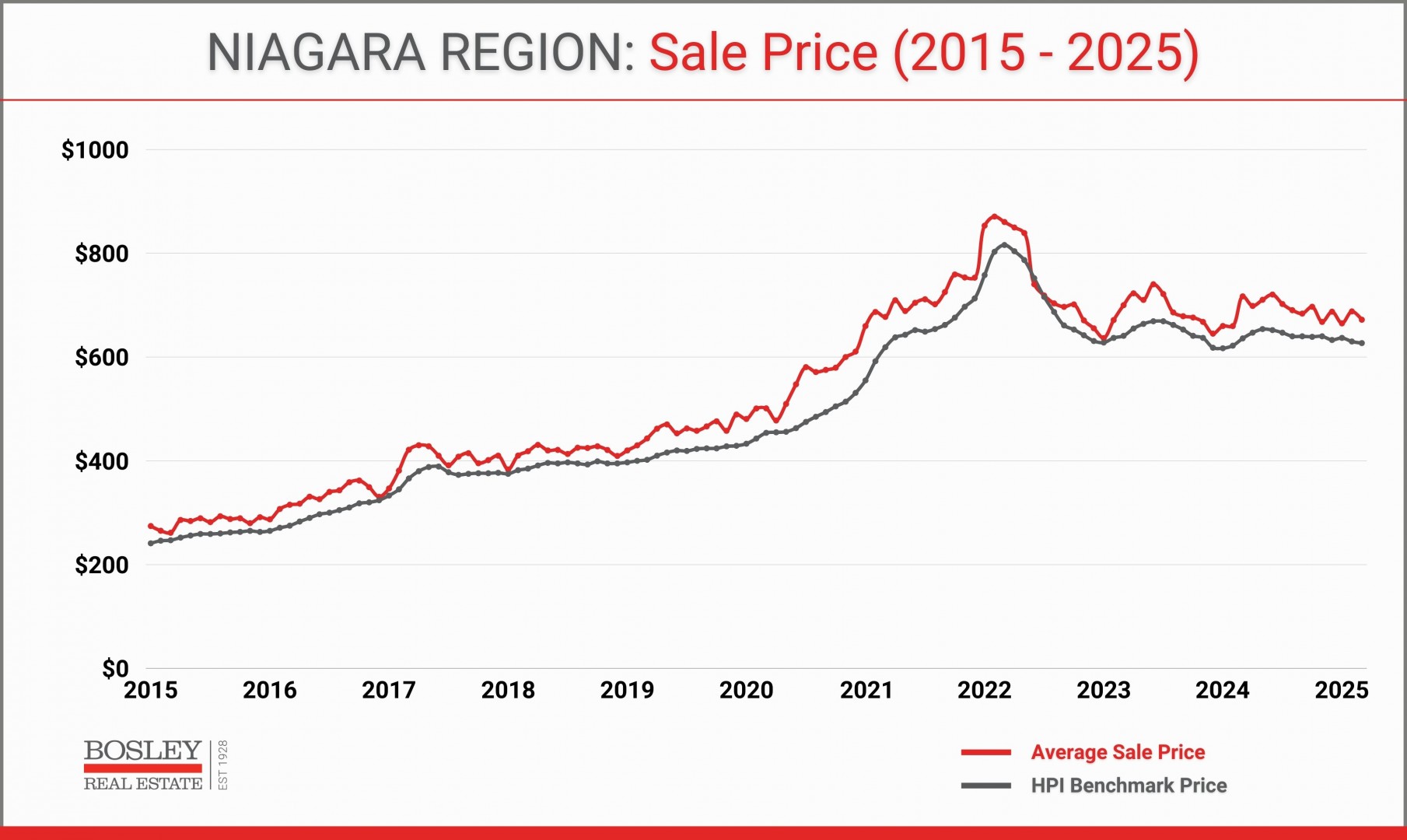

The average sale price of a home in Niagara has been remarkably flat over the past two years. After two decades of annual price appreciation, the roller coaster of the last five years has required some adjustment for many sellers. Currently, we are seeing a notable number of sellers repricing their homes multiple times until they find the sweet spot, and, ultimately, the buyer. Look no further than this chart which shows the pricing trends since 2015.

With the spike in early 2022 clearly visible, you’ll note that the price trends have otherwise been relatively flat since 2021.

The HPI benchmark price (grey line) represents the ‘typical’ home in Niagara. With the outliers out of the data, you’ll see a less volatile trend.

Prices holding steady amidst a supply and demand imbalance is notable and something we’ll continue to watch as we move into spring.

WHAT HAPPENS NEXT?

FUNDAMENTALS MATTER

Historically, the first three months of the year in Niagara have produced between 1,500 and 2,000 sales, with that number increasing through April, May and June.

Considering that the end of 2024 saw increasingly strong sales numbers, we view this current step back in momentum as directly correlated to what is (hopefully) a temporary shock due to current events.

The challenge for sellers is that while sales lag, active listing inventory is still arriving on market as we head into spring. As a result, the accuracy of the asking price is more important than ever.

When choosing your pricing strategy, it is imperative to not only look at the big picture of the market, but the specific market as it relates to your home as well.

STRATEGY

Whether you are buying or selling, this is a market that requires a clear strategy that maps out the best next steps. While the market is challenging, we’ve been through this before.

From experience, we know that the most important first step is to sit down and review your goals and real estate needs.

From there, we’ll map out a timeline and the steps needed to ensure we accomplish what we’ve set out to do.

If there is one thing we’ve learned in the last 10 years, it’s that the market can change quickly. As the saying goes, “this too shall pass”.

We're here to help anytime!