WE HAVE A PRICING PROBLEM.

Balanced market. Buyer’s market. Months of Inventory. Seller’s market. What does it all mean?

In short, they reflect market sentiment. Are buyers confident and actively purchased, or are they sitting on the sidelines? Are sellers pricing their homes realistically, or based on wishful thinking?

The reality is it all comes down to pricing. Are asking prices in line with current market conditions? Here in 2024, they do not seem to be.

First, let’s talk about Months of Inventory (MOI), a key metric in understanding the market.

The Math: MOI is calculated by dividing the number of ACTIVE listings by the number of SALES in the last 30 days.

For example, 525 active listings with 108 sales would be 525/108 = 4.9 months of inventory.

The Meaning: If nothing else was listed, it would take 4.9 months for all active listings to sell.

From there, that Months of Inventory (MOI) number is then applied to determine how balanced the market is or isn’t. A higher MOI number means that there is an abundance of inventory and/or lower demand. On the other hand, a lower MOI number might mean that inventory is more scarce and buyers are finding themselves in competition more than they’d like.

Here is where there is some variety in the meaning. Some people will say 3 to 6 months is balanced, with anything above 6 months being a buyer’s market and anything below 3 months being a seller’s market.

Here in Niagara, the data seems to show something a bit different. The following is based on previous markets and how the overall data behaved relative to MOI.

0 – 2 months = Seller’s Market

2 – 4 months = Balanced Market

4 months or higher = Buyer’s Market

What happens in a Seller’s Market?

The quick story is that buyer demand is high, and the sellers are generally running the show. It might be the result of there being too few homes for sale or it might be that there are more buyers than there are homes available.

Our most intense Seller’s Market in the past decade (or ever) was 2021 where MOI dipped down towards 2 or 3 weeks. That was a very fast-paced market that saw escalating prices, buyer frustration, and seller joy. Note: 2021 remains the only year in Niagara history with more than 10,000 annual sales.

In a seller's market, homes sell faster and for more money. The accuracy of asking prices is less important since buyers have more urgency and are willing to jump farther than normal. Overall, it’s a faster-paced market where For Sale signs turn to Sold much quicker.

What happens in a Balanced Market?

While there is price appreciation, it is very moderate. The time it takes to sell a home averages in the 30–40 days range. On occasion, a home gets a lot of attention and multiple offers, but typically, a buyer can look at a home and take a moment to think before pulling the trigger on an offer.

Offers include conditions, inspections are done, and often, a buyer can include a condition on the sale of their home. A balanced diet is something we are supposed to aspire towards and real estate is no different. This is a fairly non-eventful type of market and frankly, we’d all love to see a return to balanced.

What happens in a Buyer’s Market?

Look no further than 2024 or the majority of 2023. There are too many homes for sale and not enough people to buy them. Here in August 2024, we are going to have our 3rd consecutive month with more than 3,000 active listings. Prior to June 2024, we had never had a month with more than 3,000 active listings. Ever.

Compounding the issue is that while buyers have a lot of choice, prices are often stagnant or declining. If sellers don't adjust accordingly, listings pile up, and the market is oversaturated with overpriced listings, which, combined with reduced demand, only compounds the problem.

The teeter-totter of imbalance swings in the wrong direction.

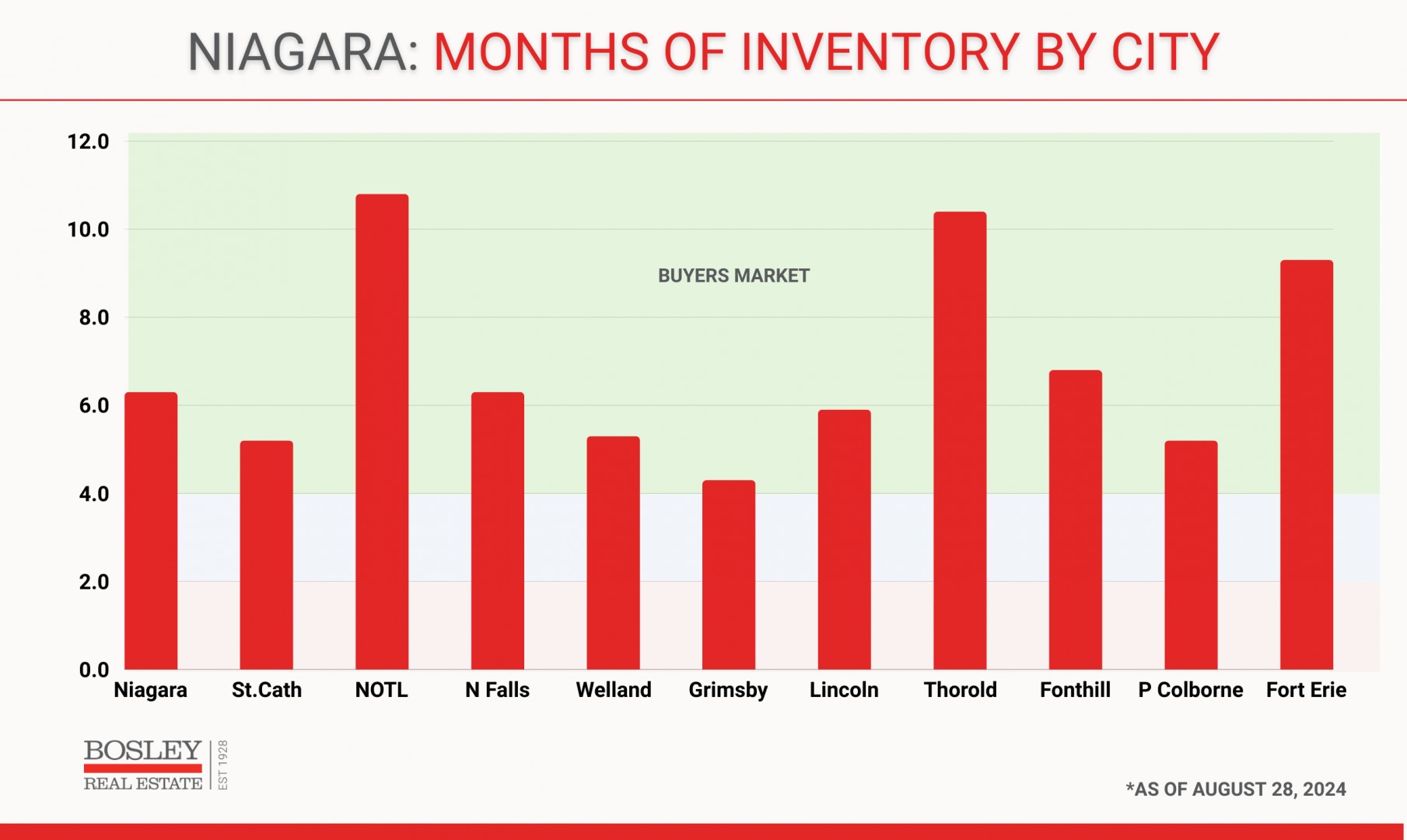

THE CURRENT PICTURE

The chart below shows you the current Months of Inventory for Niagara as well as municipalities. Some things to note:

- the shaded areas show buyer's market (green), balanced market (blue) and seller's market (red)

- the MOI figures show that as of today (August 28th), all Niagara markets are firmly in buyer's market territory

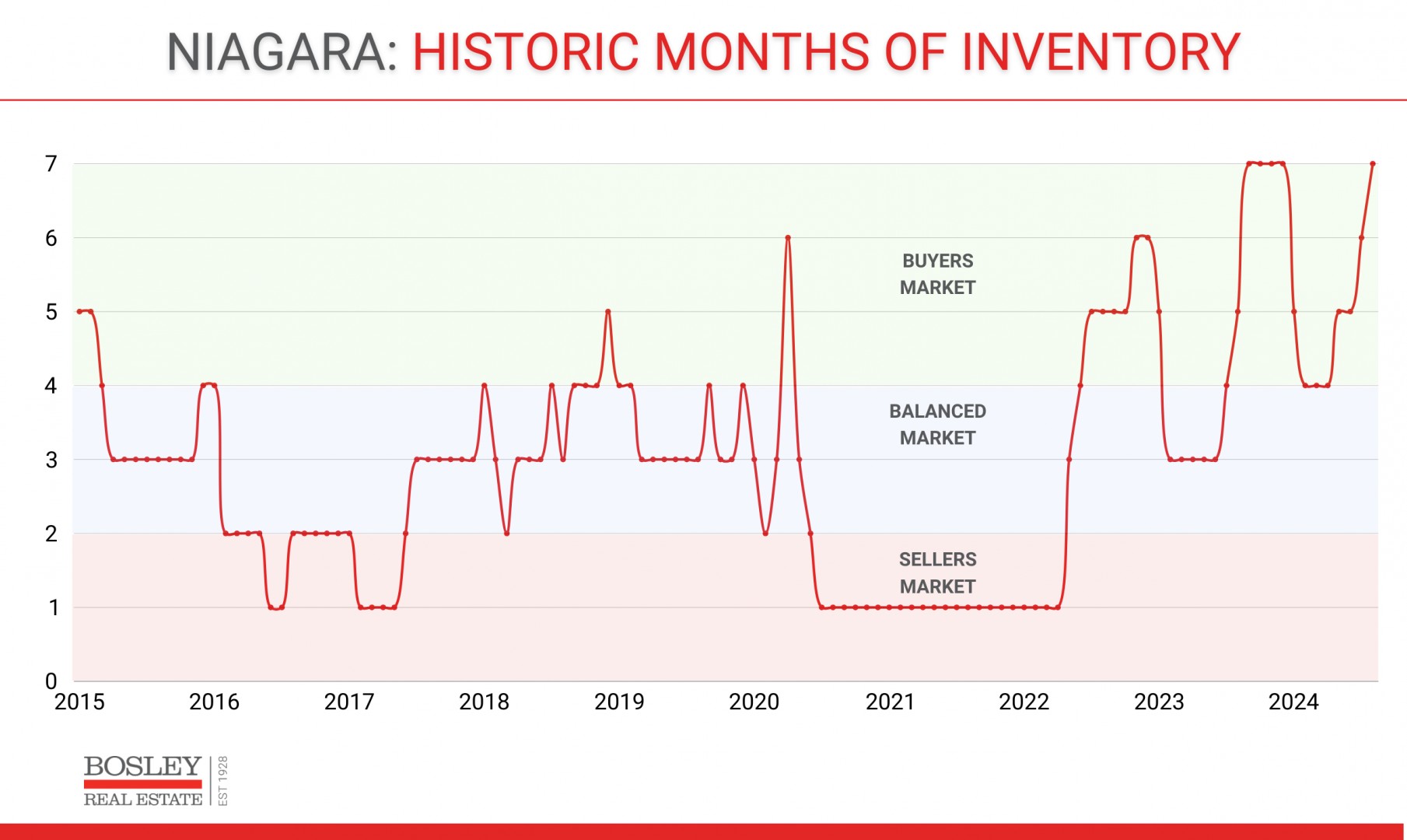

WHERE WE CAME FROM

The chart below shows you the monthly figure for Months of Inventory for Niagara going back to January 2015.

- Our biggest markets were 2016/2017 and late 2020 to early 2022 when MOI was running at 1. Those markets produced the largest sale price gains, lower days on market, and the highest number of homes sold

- The more balanced markets (2015, 2018 - 2019) produced relatively conservative gains in price, more average annual sales, and overall balanced conditions

- The previous few years have produced heavy buyers market conditions, resulting in price decreases, record high listing inventory, and record low number of homes sold (2023 and 2024 will be the 2 lowest on record)

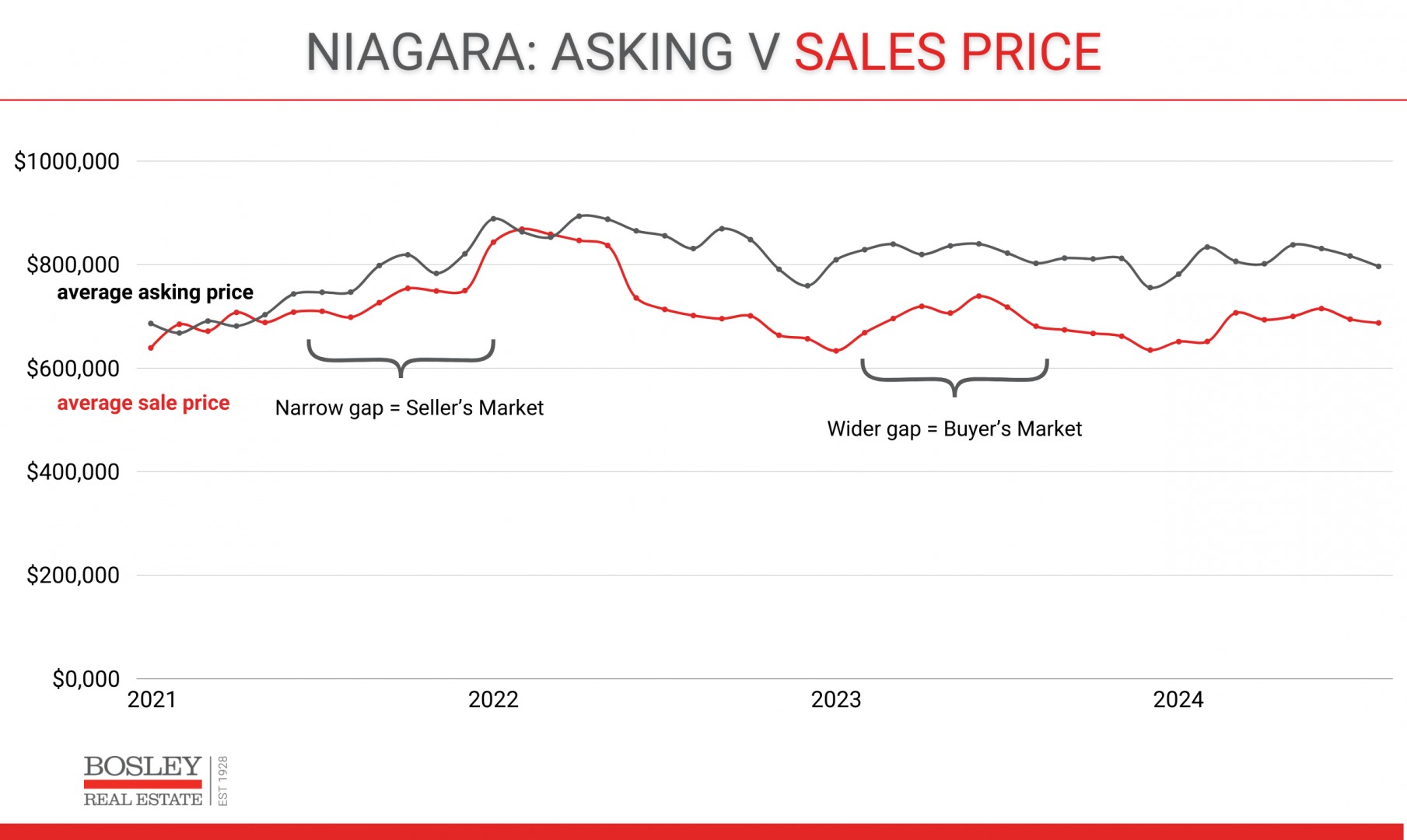

WHAT ABOUT PRICES?

The chart shows very clearly that we have a wide disparity between the asking price of homes and what people are actually paying.

- The grey line represents the asking price, while the red line represents the average sale price (new construction is not in this data)

- The very narrow gap between average asking and sale prices in the blazing hot 2021 market shows an extreme seller's market (note there were several markets in 2021 and 2022 where the average sale price exceeded the average asking price)

- The wide gap in 2023 and 2024 clearly show the impact of a heavy buyer's market, as well as the glut of over-priced listings on the market.

REASONS TO BE FEEL GOOD ABOUT THE FUTURE

Where do we go from here? There are numerous events or changes that we expect to see in the near future, that will have an impact on the market. They include:

- Asking prices need to get in line with where comparable homes are actually selling

- Once those sellers sell their homes, they become actual buyers

- The Bank of Canada needs to continue bringing down the overnight rate

- Buyer confidence and willingness to jump in needs to improve

- Surrounding markets, including the GTA, need to improve, which willl help with demand

What happens next remains to be seen, but one thing we know for sure is that the number of homes sold in 2024 will be near the record low that 2023, set with just over 6,000 sales. That low sales volume is the direct result of interest rates and market confidence, which are both at temporary levels.

Stay tuned. The balance of 2024 and 2025 will be interesting to watch.